Binance Review 2025: The Ultimate Beginner’s Guide to trading, fees, and features

As a long-time observer of cryptocurrency exchanges, I’ve consistently seen Binance stand out for its large selection of assets and steady improvements. In 2025, Binance is still the number one cryptocurrency exchange with over 200 million users worldwide. This review breaks down what it offers, how to buy crypto using Binance, and what you can expect when you start trading there.

Binance Overview

| Provider Type: | Cryptocurrency Exchange |

| Minimum Deposit: | No minimum deposit |

| Trading Fees: | Base fee of 0.1% for both makers and takers on spot trades; fees decrease with higher 30-day trading volumes or by holding Binance Coin (BNB). |

| Deposit Fees: | $0 |

| Withdrawal Fees: | Varies by cryptocurrency and network; for example, withdrawing BTC incurs a fee of 0.0000067 BTC |

| Management Fees: | None |

| Minimum trade order | $0.10 |

| Withdrawal Timeframe: | Processed within 5 minutes, subject to cryptocurrency network conditions. |

| Number of Cryptocurrencies Supported: | 388+ |

| Number of Crypto Pairs Supported: | 1,321+ |

| Top supported Cryptocurrencies: | Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), Polkadot (DOT), Shiba Inu (SHIB), Cardano (ADA), Dogecoin (DOGE) |

| Leverage: | 125x |

| Native Mobile App: | Yes, available for iOS and Android |

| Free Demo Account: | Yes, for Binance Futures |

| Customer Support: | Live chat, FAQs, Social Media, mobile |

| Verification required: | Yes, Know Your Customer (KYC) verification is required for full account functionality |

| CFD Available | No |

| Software: | Website, web app, mobile app |

| Social Trading: | Yes |

| Copy Trading: | Yes |

| Regulators | AMF, OAM, FIU, Bank of Spain, FIU, AFSA, FSRA, CBB, VARA, AUSTRAC, FIU-IND, Bappebti, JFSA, FSP, SEC, SAT, CNAD, BCR, CNV, and FIU |

Is Binance Trustworthy?

Yes, Binance is trustworthy, largely due to its adherence to recognized regulatory frameworks and security infrastructure. Overseen by reputable financial authorities such as the FCA and CySEC, Binance is subject to stringent standards aimed at safeguarding user interests. It maintains segregated accounts for client funds, ensuring that user assets remain distinct from the company’s operating capital. This approach reduces the risk of complications in cases involving liquidity issues or insolvencies.

Moreover, Binance frequently provides proof of reserves and undergoes periodic auditing. The exchange employs sophisticated encryption protocols, multifaceted authentication systems, and continuous security assessments designed to deter unauthorized access. It also encourages users to adopt best practices such as two-factor authentication (2FA) and IP whitelisting.

Is Binance Worth Using in 2025?

Yes, Binance is a great choice in 2025 for individuals seeking a comprehensive and versatile trading environment. Its user-centric ecosystem delivers a blend of advanced trading instruments, broad asset selection, and simple interface design. Those looking to experiment with new tokens, take advantage of various order types, or explore different trading strategies will find operating within Binance’s extensive platform convenient.

Also, Binance offers a rich educational framework. Newcomers who may be initially intimidated by market volatility can find guidance through tutorials, FAQs, and various learning materials embedded within the platform. As a result, users of varying skill levels often appreciate Binance’s capacity to smooth the learning curve, making it more than just an exchange – it’s a gateway that can help individuals understand the intricacies of the digital assets.

Is Binance Easy To Use?

Yes, Binance’s interface, while packed with advanced features, is structured in a manner that remains accessible to beginners. The platform organizes its functionalities logically, allowing users to navigate between spot trading, futures, staking, and other sections without feeling overwhelmed. The trading dashboards incorporate clear charting tools, order execution menus, and portfolio overviews arranged in a beginner-friendly way.

New users benefit from helpful tooltips, educational pop-ups, and well-structured FAQ pages. The mobile application mirrors these user-friendly principles, simplifying account management on-the-go. Moreover, Binance tailors some of its services for beginners – such as instant buy options and simplified trade execution – to ensure that those unfamiliar with sophisticated trading techniques do not become overwhelmed at the outset.

How To Buy And Sell Cryptocurrency On Binance

Binance has made acquiring and selling cryptocurrencies smoother over the years, letting you focus on decision-making rather than go through complicated steps.

How To Buy Cryptocurrency On Binance

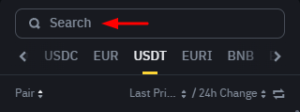

Step 2: Choose Your Trading Pair

Now, the trading interface will open, and you can select the coin you want to buy. Navigate to the search bar and type in the name of your coin. Then, select the trading pair with the coin you hold. In some cases, if you are holding fiat currency, you will need to convert it to a stablecoin like USDT or USDC since many coins don’t support fiat pairs.

Step 3: Choose Order Type

Choose the order type: market or limit. Market allows you to instantly buy your selected coin at the best available price, which you can see in the order book. Limit lets you choose the price of each coin, and once the market hits that price, your order will begin filling.

![]()

Step 4: Input Trade Details

We’ll show you how to do a limit order since this allows you to set your own prices. In the first box write how much you’re willing to pay for each coin. In the next box, input the quantity you want to purchase. Alternatively, you can use the slider, which will automatically show how many tokens you can buy based on your balance.

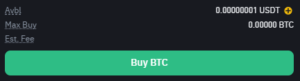

Step 5: Buy the Cryptocurrency

Finally, check the trade details to ensure that they are correct. At the bottom, you’ll see the buy button along with the estimated fees and your available balance. Press the buy button to initiate the trade. Since we set a limit order, the trade will only be completed once our cryptocurrency hits that price.

How To Sell Cryptocurrency On Binance

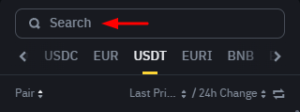

Step 2: Choose Your Trading Pair

In the trading interface, select the coin you want to sell. Use the search bar to find your cryptocurrency. Then, choose the appropriate trading pair, such as BTC/USDT if you want to sell Bitcoin for USDT.

Step 3: Choose Order Type

Decide on the type of order you want to use for selling: market or limit. A market order allows you to sell your coin immediately at the best available price in the order book. A limit order lets you set a specific price at which you want to sell, and the trade will execute only if the market reaches that price.

![]()

Step 4: Input Trade Details

Let’s use a limit order as an example. In the first box, enter the price you wish to sell each unit of your cryptocurrency for. In the next box, input the quantity of the cryptocurrency you want to sell. Also, the slider can help you quickly select a percentage of your holdings to sell based on your balance.

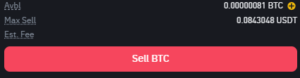

Step 5: Sell Your Cryptocurrency

Review the trade details carefully to ensure everything is correct. At the bottom, you’ll see the "Sell" button, along with the estimated fees and your current balance. Click the "Sell" button to place your order. For a limit order, the trade will only execute when the market price matches the price you’ve set.

Binance Key Features

Binance’s platform stands apart due to several features thoughtfully designed to serve various trading styles, professional needs, and personal preferences. The following are some of the most noteworthy highlights of its ecosystem.

Advanced Trading Interface

Binance’s trading platform goes beyond simple buy-and-sell functions. It incorporates highly customizable charting tools integrated with TradingView, enabling users to perform in-depth technical analysis. Multiple order types, such as limit, market, stop-limit, and OCO (One Cancels the Other), provide traders with the flexibility to execute strategies that align with their market outlook and risk tolerance. The platform’s interface is designed to adapt to different skill levels: those just starting may prefer the Basic mode, while seasoned traders can switch to Advanced mode with comprehensive chart overlays, drawing tools, and complex indicators.

Vast Cryptocurrency Selection

Binance’s extensive catalog of cryptocurrencies includes legacy giants like Bitcoin and Ethereum, alongside a selection of altcoins, stablecoins, and newly emerging tokens. This diversity appeals not only to users seeking exposure to established digital assets but also to those interested in discovering undervalued or niche projects. With more than 300 cryptocurrencies supported, traders have the option to create portfolios that align with particular investment theses, explore speculative plays, or hedge risk across different market segments.

High Liquidity and Market Depth

Binance has the highest liquidity out of any cryptocurrency exchange, enhancing the trading quality. High trading volumes lead to tighter spreads, allowing users to enter and exit positions without significant price deviations. Substantial market depth supports large order execution without dramatically influencing asset prices, appealing to both retail traders and institutional participants. This liquidity creates a more predictable trading environment where price discovery is efficient, and slippage remains minimal.

Feature-Rich Mobile Application

The Binance mobile app distills the full trading experience into a palm-sized interface. Users can effortlessly manage their portfolios, execute trades, review charts, and activate price alerts at any moment. The app even incorporates fingerprint or Face ID authentication to streamline security. While it supports advanced features such as futures trading and margin positions, it also maintains an intuitive design that allows beginners to perform straightforward trades seamlessly, bridging the gap between complexity and accessibility.

Flexible Payment and Funding Methods

Binance integrates a variety of payment rails, reflecting its global user base and commitment to accessibility. From traditional bank wires and credit/debit cards to certain localized payment gateways and third-party providers, Binance ensures that users from various jurisdictions can fund their accounts with relative ease. This openness to multiple funding methods lowers barriers to entry, allowing those who might be unfamiliar with pure crypto-to-crypto transactions to get started with fiat currencies effortlessly.

Binance Disadvantages

It should be noted that Binance, despite its comprehensive offerings, is not free from limitations. One concern that arises from time to time is regulatory complexity, as some jurisdictions impose stringent requirements that might limit the services Binance can legally provide. This can create uncertainty for users in regions that face restrictions.

Additionally, while the platform is overall intuitive, the sheer volume of features can initially feel overwhelming to those without previous exposure to trading. Although Binance offers multiple modes and guidance, some individuals may find themselves requiring additional time to fully adapt. Nonetheless, these disadvantages often pale in comparison to the multitude of features, security measures, and wide asset selection available.

Binance Cryptocurrencies and Trading Options

Binance’s multifaceted trading environment offers users a staggering array of trading instruments and digital assets. By providing access to numerous tokens – ranging from well-established coins to rapidly evolving niche projects – Binance ensures that users can implement a wide variety of trading strategies as the market matures.

What Cryptocurrencies Can You Trade on Binance?

Binance supports a diverse set of cryptocurrencies, catering to different investor interests, use cases, and market philosophies. Popular options include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Ripple (XRP)

- Polkadot (DOT)

- Solana (SOL)

- Cardano (ADA)

In addition to these well-known coins, there are more than 388 cryptocurrencies available, along with +1,321 trading pairs, allowing participants to shift from one asset to another without first converting into fiat. This extensive selection empowers traders to maintain flexible strategies, pursue emerging trends, and balance their holdings across multiple digital assets.

Can I Trade Meme Coins on Binance?

Yes, Binance frequently lists meme coins and other speculative tokens that gain traction due to community sentiment or cultural phenomena. Dogecoin (DOGE), Pepe (PEPE), and Shiba Inu (SHIB) are prominently featured on the platform. While these assets can appeal to those looking to capture lightning-fast market momentum, it is often wise to exercise caution and perform due diligence, as meme-oriented tokens can exhibit high volatility and uncertain long-term value.

What Trading Options Are Available On Binance?

Binance delivers a multifaceted suite of trading services, enabling users to engage with the cryptocurrency market in numerous ways:

- Futures trading: Utilize futures contracts to speculate on an asset’s price trajectory, hedge existing positions, or employ leverage for greater exposure.

- Spot and margin trading: Spot trading involves direct buying and selling at current market prices, while margin trading allows borrowing funds to increase potential returns – albeit with additional risks.

- Instant buy with debit/credit card: Acquire cryptocurrencies immediately using familiar payment methods, streamlining the onboarding process.

- Instant convert: Quickly exchange one crypto for another without navigating complex order books, suitable for quick portfolio adjustments.

Can I Trade Leverage On Binance?

Leverage trading is indeed available on Binance, primarily through its futures platform. Users can open positions with up to 125x leverage on select contracts, magnifying their potential gains but also significantly increasing their risk exposure. This leveraged environment appeals to active traders and professionals who deploy hedging strategies, short-term arbitrage, or high-risk/high-reward plays. However, thorough risk assessment is critical since leverage amplifies profits and potential losses.

Fees and Trade Limits On Binance

Trading costs and order size constraints shape a user’s experience. Binance incorporates a transparent fee structure and flexible trade sizes that help meet the preferences of different participants, from hobbyists placing small trades to seasoned professionals executing large volumes.

What Are The Fees For Using Binance?

| Fee Type | Description |

| Trading Fees | Typically range between 0.00% to 0.1%, adjusted based on user’s 30-day volume and account tier. Discounts may apply if users hold Binance’s native token (BNB). |

| Deposit Fees | Vary according to payment method. Crypto deposits are often free, while certain fiat channels may involve small percentages or fixed charges. |

| Withdrawal Fees | Depends on the specific blockchain network fees associated with each cryptocurrency. These fees fluctuate based on blockchain congestion and asset type. |

| Staking Fees | Generally no direct fees, but certain protocols may have nominal service charges or reduced reward rates. |

| Borrowing Fees | Apply for margin and futures trading, where the user pays interest on borrowed funds, often calculated hourly and varying per asset. |

| Leverage Fees | Embedded within futures and margin interest rates. The more leverage used, the more interest or funding fees may apply. |

What Are The Trade Limits On Binance?

Binance’s approach to trade limits is relatively flexible. The minimum trade sizes often start around $1, appealing to novices testing strategies or individuals with limited capital. As users complete higher levels of account verification, they unlock more substantial withdrawal limits and expanded trading opportunities. Institutional clients and high-volume traders enjoy elevated limits, VIP tiers, and preferential fee structures.

Those who choose to remain unverified can still trade, but they will encounter stricter constraints on daily trading volumes, withdrawal amounts, and access to certain products. This tiered system ensures that the exchange can meet compliance standards while simultaneously providing a pathway for active traders to scale their operations.

Security and Regulation

The crypto space has historically grappled with issues of security and trust, making it important for major exchanges to fortify their platforms. Binance stands out by integrating multiple layers of protection, engaging with regulators, and maintaining a compliance-oriented infrastructure that instills confidence in its user base.

Is Binance Safe?

Binance has cultivated a track record that underscores a serious commitment to safety. It employs advanced encryption protocols, routine penetration tests, and system audits to keep malignant actors at bay. Two-factor authentication is actively encouraged, ensuring that users must provide an additional verification step beyond their password. Suspicious account activities prompt automated alerts, and withdrawal whitelists add an extra layer of oversight, allowing only approved wallets to receive funds. Overall, yes, Binance is safe, but we always recommend that you withdraw to a cold wallet like the Ledger or Trezor after buying your crypto.

How Is My Crypto Protected On Binance?

User assets are kept primarily in cold storage solutions, meaning that the majority of funds remain offline and away from potential cyber threats. Binance also leverages Secure Asset Fund for Users (SAFU), an emergency insurance-like fund partially financed by trading fees, designed to compensate users in rare instances of security breaches. This two-pronged approach – isolating most user funds offline and maintaining a financial safeguard – demonstrates Binance’s commitment to investor protection.

Is Binance Regulated?

Binance operates under several regulatory bodies and collaborates with authorities to maintain compliant operations. Entities like the FCA and CySEC oversee its activities, ensuring that Binance adheres to transparency, anti-money laundering (AML), and know-your-customer (KYC) standards. These measures reassure users that the platform remains accountable, compliant, and subject to external oversight rather than operating in a vacuum.

Do I have to Verify my Account with Binance?

Account verification, also known as KYC, is highly recommended and, in many cases, mandatory to access Binance’s full range of features. Unverified accounts can perform basic trades, but they face low withdrawal limits, restricted access to certain fiat payment options, and fewer trading pairs. Verification involves submitting government-issued identification and proof-of-address documents. Verified users benefit from higher transaction allowances, unlocking a more seamless trading experience.

Binance Customer Support and Supported Countries

Binance’s global presence means it serves users from numerous countries. While it strives to assist its community effectively, specific services or features might vary depending on regional regulatory requirements or local compliance guidelines.

What Type of Customer Support Is Available on Binance?

Binance provides multiple support channels designed to address diverse user needs:

- Live chat: Initiate real-time conversations with support representatives by clicking the chat icon on the website.

- FAQs: A thorough library of frequently asked questions that covers topics from account setup to advanced trading strategies.

- Email form: Fill out an email form and submit your inquiry for personal assistance. This is a great option if you didn’t find your answer in the FAQs.

What Countries are supported on Binance?

Binance extends its services to over 180 countries, making it one of the most far-reaching exchanges in operation. Some of its most notable user bases include:

- United States

- United Kingdom

- Canada

- Australia

- Singapore

Some regions impose stringent regulations that limit Binance’s ability to offer full services. Consequently, local users might be denied certain trading pairs or derivatives products. Non-supported countries could include:

- China

- Iran

- North Korea

- Syria

- Sudan

These exclusions are due to regulatory frameworks, sanctions, and compliance issues beyond Binance’s control.

What Languages are available on Binance?

Binance accommodates a global audience by supporting over 40 languages. This linguistic diversity reflects the company’s intent to make trading accessible to individuals who speak a range of tongues. Top languages include:

- English

- Spanish

- French

- German

- Portuguese

This broad linguistic coverage assists users in navigating the platform, consuming educational content, and interacting with support representatives comfortably.

Binance Promotions and Educational Content

Binance frequently introduces programs to encourage user engagement and offers a range of educational materials to build financial literacy. This combination of promotions and resources helps individuals develop a more nuanced understanding of the market while enjoying platform-centric incentives.

What promotions does the exchange offer?

- Welcome Bonuses: New users may sometimes receive discounts on trading fees or small token rewards upon completing the verification process. Currently, they are running a promotion where you’ll receive 100 USD trading fee credit for signing up.

- Referral Programs: Binance encourages user-driven growth by rewarding individuals who bring in new clients, typically by sharing a portion of the referred user’s trading fees.

- Trading Competitions: Periodic contests allow participants to win token prizes, fee rebates, or exclusive platform perks. These contests often revolve around specific markets or newly listed assets.

- Staking Incentives: By locking certain assets into staking or savings products, users can earn passive yields. Occasionally, Binance runs promotional campaigns that boost returns or reduce lock-up periods.

What Educational Content Does Binance Offer?

- Academy: A comprehensive knowledge hub that covers topics ranging from blockchain fundamentals to advanced trading methodologies. It uses plain language and structured learning paths, making it suitable for all skill levels.

- Tutorials: Step-by-step guides that break down tasks like executing trades, setting up 2FA, or using more nuanced features like margin trading.

- FAQs: A resource for quick clarifications, troubleshooting, and straightforward instructions on managing accounts and wallets.

- Blog and Articles: Regularly updated market insights, industry news, and platform announcements to keep users informed about the latest developments and enhancements.

Binance Deposit, Withdrawal and Payment Options

Binance’s financial infrastructure accommodates various deposit and withdrawal preferences. Users can choose the methods most aligned with their circumstances, including traditional banking services or crypto-to-crypto transfers.

Accepted payment methods may include:

- Bank Transfer: Common for fiat-to-crypto conversions; processing times may vary.

- Credit/Debit Cards: Convenient for immediate purchases, though fees might be slightly higher than other funding routes.

- Cryptocurrency Transfers: Nearly instant and cost-effective, suitable for users already holding digital assets in external wallets.

- Third-Party Payment Providers: Depending on the region, Binance may integrate with local e-wallets or payment gateways to streamline fiat movements.

What Alternatives Are There To Binance?

While Binance excels in many dimensions, some traders may explore other platforms that align more closely with their geographic restrictions, investment strategies, or regulatory comfort levels.

| Exchange | Features |

| Coinbase | User-friendly platform, strong regulatory compliance, wide fiat support. |

| Kraken | Emphasis on security and AML compliance, margin and futures trading, extensive crypto listings. |

| Huobi Global | Competitive trading fees, token offerings, and staking services. |

| Bitfinex | Advanced order types, API integrations, liquidity suitable for pro traders. |

| OKX | Diverse trading instruments, including margin and futures, plus a mobile-friendly interface. |

Final Thoughts

Binance remains the leading cryptocurrency exchange in 2025. Its wide range of supported coins, high liquidity, and evolving suite of trading products make it appealing to beginners and professionals. While the complexity of its offerings may require some acclimation, the platform’s educational resources and tiered functionalities reduce the intimidation factor.

In sum, Binance’s continuous evolution has allowed it to address the needs of a changing market. It suits casual traders looking for basic buy-and-sell functions as well as advanced users interested in technical charting, futures contracts, and strategic portfolio construction. Its persistent efforts toward compliance and safety, alongside consistent user-focused refinements, reinforce its status as a reliable, forward-looking platform in the digital asset market ecosystem.

FAQs

Can I Use Binance Without Verifying My Identity?

Yes, it is possible to register an account and perform limited trades without completing full verification. However, unverified accounts face lower withdrawal limits, restricted access to certain trading products, and possible limitations on supported fiat payment methods. To maximize the platform’s offerings and enjoy smoother transactions, verification is strongly recommended.

Does Binance Support Credit Card Purchases of Crypto?

Yes, Binance enables users to buy cryptocurrencies via credit and debit cards. This feature simplifies the onboarding process by allowing immediate purchases using familiar financial tools, making it appealing to those who prefer not to navigate more complex payment pathways.

Is Binance Suitable for Beginners?

Yes, although Binance features a sophisticated interface, its tiered layout, educational resources, and beginner-friendly trading modes help newcomers get started. Less experienced users can rely on the instant buy feature, FAQs, and tutorials, gradually progressing toward more advanced functions as they gain confidence and market familiarity.

How Does Binance Enhance Platform Security?

Binance deploys advanced security measures, including cold storage of the majority of user funds, multi-factor authentication, routine security audits, and continuous monitoring for suspicious activity. The SAFU fund provides a financial safety net, underscoring Binance’s proactive approach to user protection.

Can I Trade On Binance Using My Mobile Device?

Yes, Binance’s mobile application is optimized for both iOS and Android platforms. It offers a full range of features, from chart analysis and order placement to notifications and account management, enabling traders to remain engaged even when away from their desktops.