Coinbase is the 3rd largest exchange with over 73 million users worldwide. This review will walk you through everything you need to know about Coinbase in 2025, helping you decide if it’s the right exchange for your needs.

Coinbase Overview

| Provider Type: | Cryptocurrency Exchange |

| Minimum Deposit: | $1 |

| Trading Fees: | Coinbase Advanced has a maker-taker fee model with fees ranging from 0.00% to 0.60%, depending on 30-day trading volume and order type. |

| Deposit Fees: | ACH transfers are free; wire transfers have a $10 fee. |

| Withdrawal Fees: | ACH withdrawals are free, crypto wire transfers have a $25 fee. |

| Withdrawal Timeframe: | 1 to 30 minutes, depending on withdrawal method |

| Management Fees: | None |

| Minimum trade order | $1 |

| Number of Cryptocurrencies Supported: | 240+ |

| Number of Crypto Pairs Supported: | 300+ |

| Top supported Cryptocurrencies: | BTC, ETH, LTC, XRP, DOT, BCH, ATOM |

| Leverage: | 20x |

| Native Mobile App: | Available for iOS and Android |

| Free Demo Account: | No |

| Customer Support: | Live chat, comprehensive FAQs, and social media support |

| Verification required: | KYC |

| CFD Available | No |

| Software: | Accessible via web browser and mobile app |

| Social Trading: | No |

| Copy Trading: | No |

| Regulators | FCA, BaFin, Central Bank of Ireland, DNB, OAM, SEC |

Is Coinbase Trustworthy?

Yes, Coinbase is widely regarded as a trustworthy platform in the cryptocurrency industry. The exchange complies with strict regulations from authorities like the FCA (UK), SEC (USA), and BaFin (Germany), which ensures it operates transparently and securely. Also, Coinbase uses cold storage for the majority of its funds, segregates customer assets from company funds, and regularly proves reserves to maintain trust with its users.

Is Coinbase Worth Using in 2025?

Coinbase is one of the most reliable and accessible cryptocurrency exchanges available today, and it continues to provide top-tier services in 2025. Its clean interface and straightforward tools make it an excellent starting point for beginners, while Coinbase Advanced Trade offers features like lower fees, advanced charting, and customizable orders to satisfy more experienced users.

What sets Coinbase apart is its regulatory compliance, overseen by trusted authorities like the SEC and FCA, and its commitment to security with cold storage and insurance for online funds. Furthermore, with over 240 cryptocurrencies, options for staking to earn rewards, and a seamless fiat-to-crypto system, Coinbase provides a well-rounded platform for casual investors and serious traders.

Is Coinbase Easy To Use?

Yes, Coinbase is one of the most easiest cryptocurrency exchanges to use in 2025. It stands out for its streamlined design, offering an interface that feels approachable even for users with no prior experience in cryptocurrency. The sign-up process is quick and straightforward, and features like instant buy and recurring purchases make managing crypto investments hassle-free. Coinbase also simplifies tasks like depositing fiat, checking balances, and accessing key tools, ensuring users can focus on their trading goals without navigating unnecessary complexity.

How To Buy And Sell Cryptocurrency On Coinbase

Here’s how to buy cryptocurrency on Coinbase. We’ll show you how to use Coinbase Advanced since it offers the lowest trading fees.

How To Buy Cryptocurrency On Coinbase

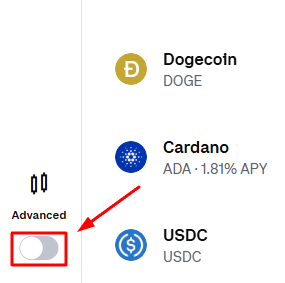

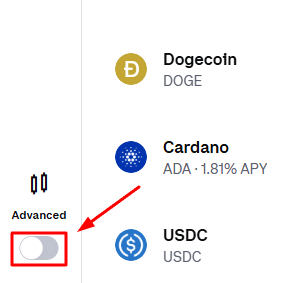

Step1: Switch to Coinbase Advanced

Log in to your Coinbase account and find the Advanced toggle at the bottom left of the interface. Click the toggle to switch to the Advanced version, which offers lower fees and a professional-grade trading interface.

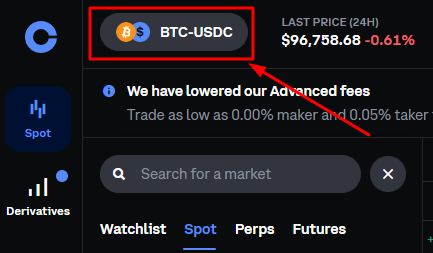

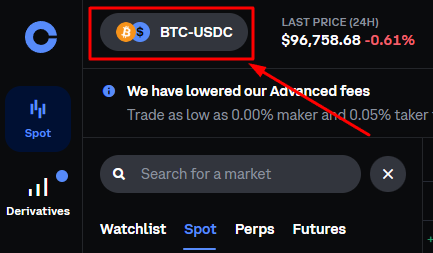

Step 2: Access the Trading Interface

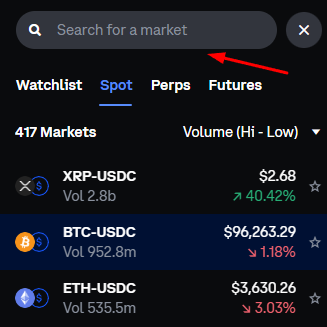

Once in Coinbase Advanced, click on the current trading pair displayed at the top of the dashboard. This opens a tab with all available cryptocurrency trading pairs.

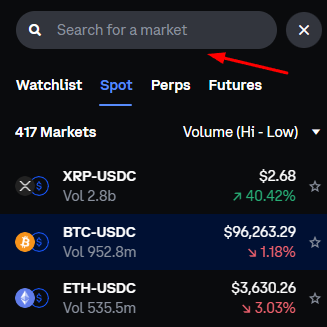

Step 3: Select a Trading Pair

Use the tab to browse available trading pairs, or type the desired pair (e.g., ETH/USD) into the search bar for faster navigation. Click your selected pair to open the trading page.

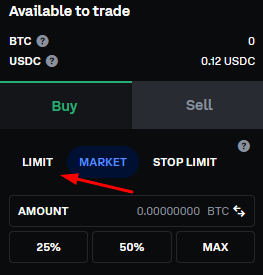

Step 4:Choose Your Order Type

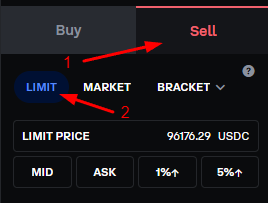

Select from three types of buy orders available in Coinbase Advanced:

- Market Order: Executes instantly at the current market price.

- Limit Order: Allows you to set a specific price to buy at.

- Stop Limit Order: Combines a stop price (trigger) with a limit price, ensuring your order is executed within a set range once the stop price is reached.

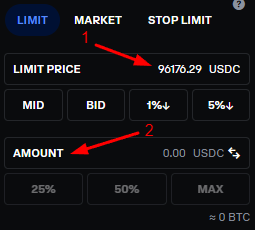

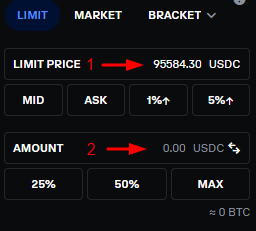

Step 5: Setting a Limit Order on Coinbase Advanced

Here’s how to set up a limit order:

- Limit Price: Type in the price you’re willing to pay per unit of the cryptocurrency. This is your chosen price for the trade.

- Amount: Enter how much cryptocurrency you want to buy. You can type it in manually or use the buttons (like 25%, 50%, or MAX) to pick an amount based on your available balance.

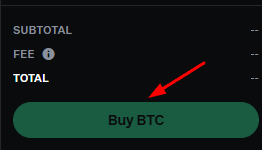

Once everything looks good, double-check the total cost at the bottom, then click Buy to confirm. Your order will wait until the market reaches your price, and then it will complete automatically.

How To Sell Cryptocurrency On Coinbase

Step 1: Switch to Coinbase Advanced

After logging into your Coinbase account, look for the Advanced switch option at the bottom left of your screen. Click it to enter the advanced trading interface.

Step 2: Open the Trading Pairs Tab

Once inside Coinbase Advanced, click the current trading pair displayed at the top of the screen. Clicking on it will bring up a menu listing all available trading pairs.

Step 3: Select the Cryptocurrency Pair You Want to Trade

In the trading pairs menu, search for the pair that matches the cryptocurrency you want to sell, such as BTC/USD. Either scroll through the list or use the search bar to quickly locate the right option. Click on it to proceed to the trading page.

Step 4: Switch to the Sell Interface and Select Order Type

Begin by clicking the Sell button at the top of the trading page to switch to the selling interface. After that, select your preferred order type—Limit, Market, or Bracket. We’ll use Limit, which gives you control over the price at which your cryptocurrency is sold.

Step 5: Enter Your Order Details and Sell

Setting up your sell order requires two inputs to finalize the process:

- Limit Price: Set the price at which you want to sell each unit of your cryptocurrency. This ensures the trade only executes at or above your desired price.

- Amount: Input the number of units you want to sell. You can either type in the exact quantity or use the percentage shortcuts, such as 25%, 50%, or MAX, to select a portion of your holdings.

Once these details are entered, press the Sell button to complete the order. Your trade will execute once the market price matches your specified limit price.

Coinbase Key features

Seamless Fiat-to-Crypto Transactions

Coinbase simplifies the process of buying cryptocurrency directly with fiat currencies. Users can link their bank accounts or use debit/credit cards to purchase assets like Bitcoin and Ethereum almost instantly, making it one of the easiest platforms for converting fiat to crypto.

Coinbase Wallet

The Coinbase Wallet is a standalone application that enables users to manage their private keys and access decentralized applications (dApps). Supporting a wide range of cryptocurrencies and non-fungible tokens (NFTs), the wallet provides users with full control over their digital assets, separate from the main Coinbase exchange.

Staking Integration

Users can stake supported cryptocurrencies, such as Ethereum and Solana, to earn staking rewards. The staking feature is integrated directly into the platform, eliminating the need for external wallets or complex processes.

Coinbase Card

The Coinbase Card allows users to spend their cryptocurrency at millions of merchants worldwide. It automatically converts crypto to fiat at the point of sale and offers cashback rewards on certain transactions, making it practical for everyday use.

Learn and Earn Program

Coinbase’s “Learn and Earn” initiative allows users to earn cryptocurrency by engaging with educational content. Users watch videos and complete quizzes about specific cryptocurrencies, receiving small amounts of those assets upon successful completion. This program facilitates learning while simultaneously building a diversified crypto portfolio.

Coinbase Disadvantages

Despite its strong reputation and user-friendly interface, Coinbase has a few drawbacks that potential users should consider before committing to the platform.

- High Fees on Standard Trading: Standard transactions can incur significant fees, with rates up to 3.99% for credit/debit card purchases. Users not utilizing Coinbase Advanced may find trading costs prohibitive, especially for frequent or high-volume trades.

- Limited Control Over Private Keys: Funds stored on Coinbase are custodial, meaning users do not have direct access to their private keys unless using the separate Coinbase Wallet. This setup may not appeal to those who prioritize full control of their assets.

- Regional Restrictions: Coinbase is not universally available, with some countries facing limited or no access to its services due to regulatory barriers. This limits its functionality for users in affected regions.

- No Free Demo Account: The absence of a demo trading option makes it difficult for beginners to practice trading strategies without risking real funds, putting newcomers at a disadvantage compared to platforms offering this feature.

Coinbase Cryptocurrencies and Trading Options

Coinbase provides access to a wide range of cryptocurrencies and trading features, making it a versatile platform for diverse trading needs. Below is a detailed overview of what Coinbase offers.

What Cryptocurrencies Can You Trade on KuCoin?

Coinbase supports a large number of cryptocurrencies, mainly established projects that have great potential. Rarely have we seen Coinbase list cryptocurrencies that have no team backing, roadmap, or mainstream popularity. Some of the top cryptocurrencies available include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Avalanche (AVAX)

- Cardano (ADA)

- USD Coin (USDC)

- Dogecoin (DOGE)

- Polygon (MATIC)

- Polkadot (DOT)

Coinbase has over 240 cryptocurrencies and 300 trading pairs on the platform, offering a broad spectrum of options for users. This makes it easy to diversify your portfolio from one platform.

Can I Trade Meme Coins on Coinbase?

Yes, Coinbase has listed popular meme coins on their exchange. Users can trade assets like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) directly on the platform. While meme coins can be volatile, their inclusion on Coinbase allows traders to access these trending tokens easily. Here are the top meme coins on Coinbase:

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

- Floki Inu (FLOKI)

- Bonk (BONK)

- Dogwifhat (WIF)

What Trading Options Are Available On Coinbase?

Coinbase offers an array of trading opportunities, ranging from fundamental spot transactions to more intricate derivative strategies:

- Cryptocurrency Pairs: Trading one crypto against another, an avenue that can exploit relative price movements without exiting into fiat.

- Futures Trading: Contracts that allow speculation on future asset prices. Traders can hedge holdings or leverage positions to potentially magnify returns.

- Spot and Margin Trading: Spot trades settle immediately, while margin accounts empower traders to borrow funds, enhancing their exposure but also introducing additional risk.

- Instant Buy with Debit/Credit Card: Streamlines the purchase process, allowing near-instant access to digital assets without navigating order books.

- Instant Convert: Enables quick crypto-to-crypto conversions, ideal for fast portfolio adjustments responding to shifting market conditions.

Can I Trade Leverage On Coinbase?

Yes, Coinbase accommodates leveraged trading with maximum leverage reaching up to 20x in certain futures markets. The leverage amount can be adjusted based on your trading strategy for convenience.

Fees and Trade Limits On Coinbase

Anyone who trades regularly knows that fees and transaction limits can impact profitability over time. Understanding these details helps set realistic expectations and avoid unexpected costs. Coinbase’s fee structure is transparent, and while some may wish for lower costs, the value-add of reliability and accessibility should also be considered.

What Are The Fees For Using Coinbase?

| Fee Type | Description |

| Trading Fees | Between 0.05% and 0.60%, influenced by user trading volume and tier. Some discounts apply if you meet certain trading thresholds or hold specified tokens. |

| Deposit Fees | Vary depending on the chosen payment method. Crypto deposits are often free aside from miner fees, while fiat deposits might carry small or percentage-based charges. |

| Withdrawal Fees | Depend on the asset and network congestion. Crypto withdrawals incur miner fees, which fluctuate, while certain fiat withdrawals might have fixed or percentage-based costs. |

| Staking Fees | Usually minimal or embedded in protocol-level fees. Some staking arrangements might skim a small percentage of rewards as a service cost. |

| Borrowing Fees | For margin or futures trades, borrowing fees apply, reflecting the interest on leveraged positions. These rates change based on asset supply, demand, and contract specifications. |

| Leverage Fees | Included in futures funding rates, adjusted periodically based on the difference between spot and futures prices, ensuring equilibrium in the market. |

What Are The Trade Limits On Coinbase?

Trade limits vary according to the user’s verification level. People who only complete basic checks may find daily or monthly withdrawal caps and smaller trading allowances. Completing full KYC verification expands these boundaries, allowing for larger trades, higher withdrawal limits, and access to all payment corridors. Minimum trades tend to hover around $1, which keeps things accessible even to those just starting out. Larger and more active participants will appreciate that these limits scale up significantly as they verify accounts and reach higher tiers.

Security and Regulation

Security and compliance have built Coinbase’s reputation and continue to be central to its services in 2025. Many individuals who are new to digital assets feel more comfortable using a platform that emphasizes a secure environment and operates under recognized regulatory frameworks. This section focuses on how Coinbase handles user protection, regulatory oversight, and account verification procedures.

Is Coinbase Safe?

Coinbase has gained a solid reputation for security practices that protect user funds. It employs encrypted connections, multi-factor authentication, and regular audits. These measures help ensure that sensitive user data, such as login details and personal information, remains protected from unauthorized access. The platform also conducts continuous monitoring to detect unusual behavior and freeze problematic accounts.

Most digital assets on Coinbase are stored in cold storage wallets. These are offline wallets that stay disconnected from the internet and thus are less exposed to digital threats. Keeping a majority of assets in cold storage enhances overall resilience against hacking attempts and online attacks.

Two-factor authentication (2FA) is strongly encouraged for all users. Those who enable 2FA must provide an additional confirmation – often a code generated on their mobile device – when signing in or performing important account actions. This extra step significantly reduces the risk of compromised login credentials.

How Is My Crypto Protected On Coinbase?

A substantial portion of user assets reside in cold storage, meaning they are not exposed to the public internet, which reduces the risk of hacks. Coinbase also maintains an insurance fund that can help cover losses from specific breaches. Combined with transparent policies and no tolerance for malicious behavior, this forms a comprehensive approach: not only are the digital keys kept secure, but contingency plans also exist. Although insurance and safeguards are not a license to be complacent, it does add reassurance that your assets are not left vulnerable without any fallback.

Is Coinbase Regulated?

Yes, Coinbase operates under regulators like the FCA and CySEC. This does not mean Coinbase’s every move is rubber-stamped by these bodies, but it indicates that the platform abides by established financial guidelines, adheres to anti-money laundering requirements, and respects know-your-customer rules.

Do I have to Verify my Account with Coinbase?

Yes, if you want the full Coinbase experience, verification is necessary. Non-verified accounts face tighter restrictions on trading volumes, withdrawals, and certain features. Submitting ID documents might feel like a small inconvenience, but it opens the door to a much richer experience. This ensures compliance and discourages illicit activities. Most exchanges that aim for long-term credibility follow this path, and Coinbase is no exception. Verifying also often means you can deposit and withdraw larger amounts, access fiat gateways, and potentially benefit from lower fees or exclusive features down the line.

Coinbase Customer Support and Supported Countries

Digital assets are global by nature, and Coinbase attempts to serve a diverse, international customer base. This means not only making the platform accessible in multiple languages but also ensuring that support channels can handle issues from users spread across many time zones and regulatory environments.

What Type of Customer Support Is Available on Coinbase?

- Live chat: Ideal for immediate queries, providing real-time assistance that can resolve problems faster than waiting for email responses.

- Email Support: support@coinbase.com is available if you need to send attachments, longer explanations, or prefer a written record of communication.

- FAQs: A well-organized FAQ section can solve many issues instantly, without even having to contact support staff. Coinbase’s FAQs address common questions, covering everything from account security tips to fee explanations.

What Countries are supported on Coinbase?

Coinbase Operates globally and serves over 100 countries. Popular markets include:

- United States

- United Kingdom

- Canada

- Australia

- Singapore

However, regulatory restrictions mean not every country can access all Coinbase features. Some places face limitations due to local laws, making certain trading pairs or derivatives unavailable. Other nations may impose capital controls or specific licensing requirements. Countries not supported often include those with heavy sanctions or strict prohibitions on digital assets, such as:

- China

- Iran

- North Korea

- Syria

- Sudan

What Languages are available on Coinbase?

Coinbase supports more than 40 languages. The top languages include:

- English

- Spanish

- French

- German

- Portuguese

Having so many language options helps users navigate the platform without struggling through translations. This linguistic flexibility contributes to a more welcoming atmosphere, letting people focus on the trading itself rather than deciphering instructions in an unfamiliar language.

Coinbase Promotions and Educational Content

The concept of an exchange that not only provides trading functionalities but also invests in user education and offers incentives might have seemed far-fetched years ago. However, Coinbase runs various promotional campaigns and shares learning materials that can help traders improve their understanding, refine strategies, and stay informed about the ever-shifting crypto landscape.

What promotions does Coinbase offer?

- Welcome Bonuses: Newcomers might receive discounted trading fees or small crypto bonuses after completing verification, adding a bit of encouragement to get started.

- Referral Programs: Existing users who introduce friends to Coinbase can earn referral rewards, benefiting both themselves and new joiners.

- Trading Competitions: Occasionally, traders can join contests that reward high-volume participants with tokens or fee rebates, introducing a gamified element into the experience.

- Staking Promotions: Coinbase might boost staking yields for a limited time, allowing users to explore passive earning opportunities through holding specific coins.

What Educational Content Does Coinbase Offer?

- Academy: A structured learning hub that breaks down complex topics into approachable lessons, ensuring that even brand-new users can understand blockchain fundamentals and trading concepts over time.

- Tutorials: Clear instructions on performing various tasks, like placing limit orders, setting up two-factor authentication, or transferring crypto to external wallets, which leave less room for confusion.

- FAQs: Quick reference points that deliver immediate answers to common queries, meaning users do not need to wade through support queues for simple clarifications.

- Blog and Articles: Regularly updated content on market trends, new coin listings, and platform features helps traders stay ahead of the curve and adjust strategies as circumstances change.

Coinbase Deposit, Withdrawal and Payment Options

The process of putting money into the platform or taking it out again should be difficult. Coinbase attempts to ensure that both deposit and withdrawal steps feel as smooth as possible. Multiple payment methods give users the freedom to use what fits their personal financial ecosystem best.

Funding options might include:

- Bank Transfer: Traditional but reliable, potentially with lower fees, though processing times vary by region.

- Credit/Debit Cards: Handy for those who value speed and convenience. Although potentially pricier, card purchases ensure near-instant funding.

- Cryptocurrency Transfers: Perfect for anyone already holding crypto in another wallet, transferring directly into Coinbase’s ecosystem without waiting for fiat intermediaries.

- Third-Party Payment Providers: Depending on the user’s location, certain e-wallets or payment gateways might integrate with Coinbase, making deposits and withdrawals feel as straightforward as online shopping.

Withdrawal times vary, with crypto withdrawals often completing quickly once confirmed by the network, and fiat withdrawals depending largely on traditional banking hours and regulatory checks. The point is that Coinbase gives you enough variety to find something that works for your situation.

What Alternatives Are There To Coinbase?

Exploring other platforms might be wise for traders who want to find a specific feature that Coinbase does not offer. While Coinbase remains strong and versatile, there is no harm in checking out competitors that might specialize in certain areas.

| Exchange | Features |

| Binance | Massive token selection, advanced derivatives, lower trading fees. |

| Kraken | Known for strong security, margin options, and a wide range of fiat on-ramps. |

| Huobi Global | Broad altcoin coverage, staking services, intuitive user experience. |

| Bitfinex | Advanced order types, high liquidity, appealing for sophisticated traders. |

| OKX | Derivatives markets, savings products, user-friendly mobile interface. |

Final Thoughts

Coinbase, by 2025, appears to have found its stride as a platform that balances accessibility and sophistication. It is not just an entry-level exchange anymore; it has evolved into a service that can keep pace with trader ambitions as they learn and gain experience. The presence of regulatory oversight, robust security measures, and a wide asset selection helps it maintain credibility in a market where trust has not always come easy.

While newcomers will appreciate how approachable Coinbase feels, expert traders can use advanced features and market segments. The comprehensive learning resources, mobile integration, and multiple funding options address common pain points that once plagued early crypto adopters. Some drawbacks, such as feature availability in certain jurisdictions or a mildly intimidating breadth of options, do exist, yet they do not overshadow the overall usability and reliability that Coinbase brings.

At the end of the day, Coinbase is worth considering if you value a platform that started simple, evolved thoughtfully, and now stands ready to help you navigate a digital asset market that looks more legitimate and dynamic than ever before.

FAQs

How long do deposits and withdrawals take on Coinbase?

Cryptocurrency deposits and withdrawals often finalize quite fast, subject to network confirmation times. Fiat transactions vary based on banking hours and payment methods, meaning it could take a few business days in some cases. The platform does provide estimates and status updates so you can monitor progress.

Does Coinbase support credit card purchases of crypto?

Yes, Coinbase does support credit and debit card payments. This method speeds up the process of acquiring crypto, though you might pay slightly higher fees compared to bank transfers. The convenience factor and immediate fund availability often justify the extra cost for many users.

Is Coinbase suitable for beginners?

Absolutely. Coinbase has built a reputation as a beginner-friendly platform thanks to its intuitive interface, extensive FAQs, and educational content. Beginners can start with simple buy/sell actions and gradually explore more advanced features as they gain confidence.

How does Coinbase ensure platform security?

Coinbase blends security elements like cold storage for most user funds, ongoing audits, two-factor authentication, and monitoring, aiming to deter hackers and provide peace of mind. While no system is foolproof, Coinbase’s ongoing investment in security keeps it a step ahead of many rivals.

Can I access Coinbase on my mobile device?

Yes, Coinbase’s mobile app is well-developed and maintains nearly all the functionalities of the desktop version. You can trade, monitor markets, set price alerts, and handle administrative tasks from your phone or tablet, ensuring that you can manage your portfolio from anywhere at any time.